The Complete Guide to Equipment Financing: Loans, Leasing, and Sale-Leaseback

Discover the complete guide to equipment financing—loans, leasing, and sale-leaseback. Learn pros, cons, and strategies to fuel business growth.

Your blog category

Discover the complete guide to equipment financing—loans, leasing, and sale-leaseback. Learn pros, cons, and strategies to fuel business growth.

Learn how to prepare for a business loan application with the right documents, financial ratios, and timelines. Boost your approval chances with this step-by-step guide.

Discover the main types of business loans—from term loans and working capital financing to government-backed SBA and CSBFP programs. Learn how each works, who they’re best for, and how to choose the right option for your business.

Discover how business loans work, the different types available, and how to choose the right one for your company’s needs. Learn the benefits, risks, and tips to secure financing successfully.

Canada has overhauled its SR&ED tax credit program to better support R&D in innovative sectors. The 2024 changes expand access, increase credit limits, and reintroduce capital expenditures. This article explores what the new rules mean for healthcare and life sciences businesses — and how to maximize the benefits.

Learn how invoice factoring helps B2B businesses turn unpaid invoices into immediate cash flow. Discover the process, benefits, and how a broker like Finmed Capital can connect you with the right factoring partner.

Learn what working capital really means for your business, how to calculate it, and practical ways to improve it—especially if you're seeking financing.

Learn why lenders prioritize DSCR and how knowing your Debt Service Coverage Ratio can make or break your business financing approval.

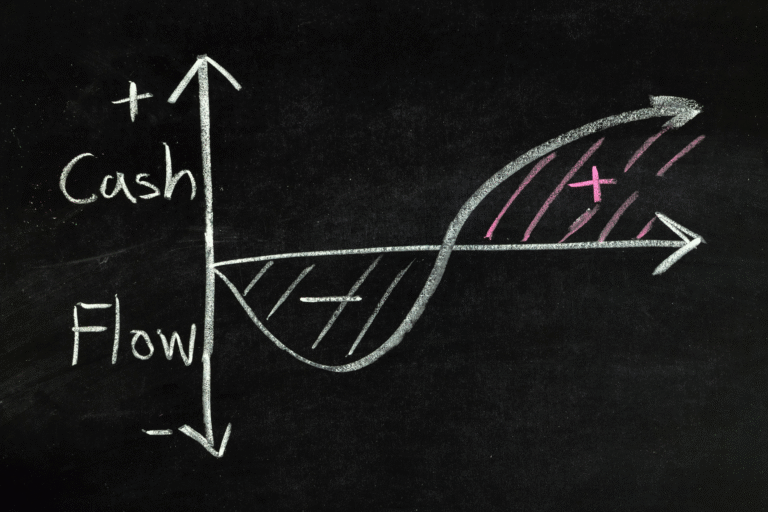

Cash flow — not profit — is what lenders care about most. Learn how strong cash flow helps you qualify for financing, and how Finmed Capital can help.

Discover how sale-leaseback financing allows healthcare businesses to unlock capital tied up in assets—without disrupting operations or adding debt.